Intro

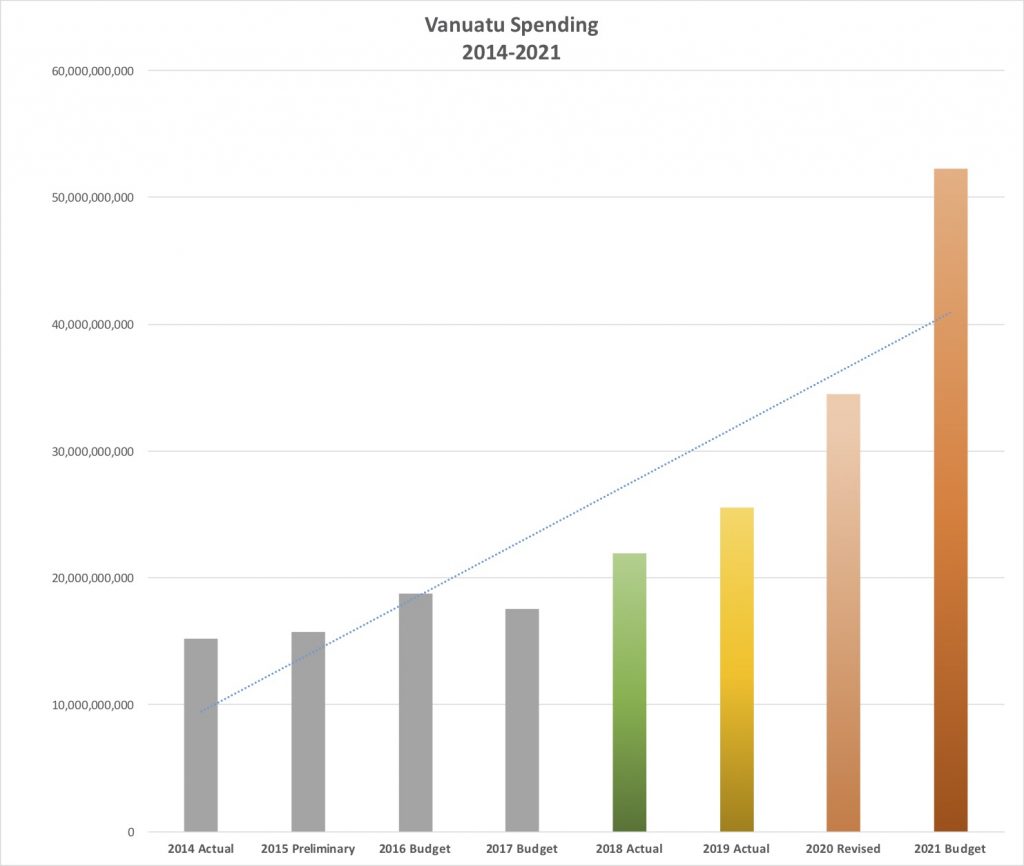

The VT 52 billion sticker on next year’s budget seems high, but it’s actually on scale with previous years. Most of next year’s rise in spending compensates for money not spent this year.

Every vatu the government wants to spend has to be approved by Parliament. But not everything approved gets spent. The twin disasters of cyclone Harold and COVID-19 wreaked havoc on the government’s plans. It ended up spending about VT 9 billion that wasn’t in the original budget, and it left other billions unspent.

A lot of that unspent budget has been rolled forward into 2021, and that’s why it’s so big compared to previous years. It’s common for governments to table a budget that’s bigger than what actually gets spent. When we compare budgeted amounts to actual historical spending, we can see this clearly.

Another item that sometimes confuses people is the fact that MPs have to approve all spending, no matter where it comes from. Only VT 38 out of the overall 52 billion comes directly from government coffers. The rest is donor funded.

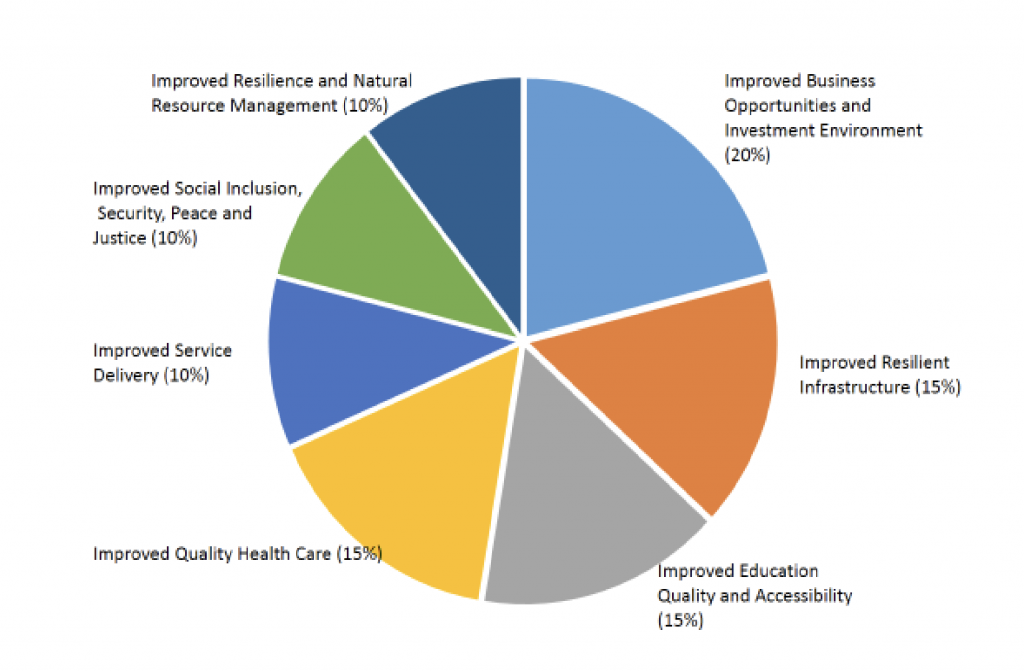

Mismatched Priorities

The government’s budget policy statement shows a balance of priorities that reflects the vision of the country resting on three pillars of society, the environment and the economy.

But this year’s allocation tells a different tale. The Ministries of Justice and Youth & Sport are starved, compared to the others. Infrastructure and Public Utilities towers over the rest, with a full quarter of all money allocated.

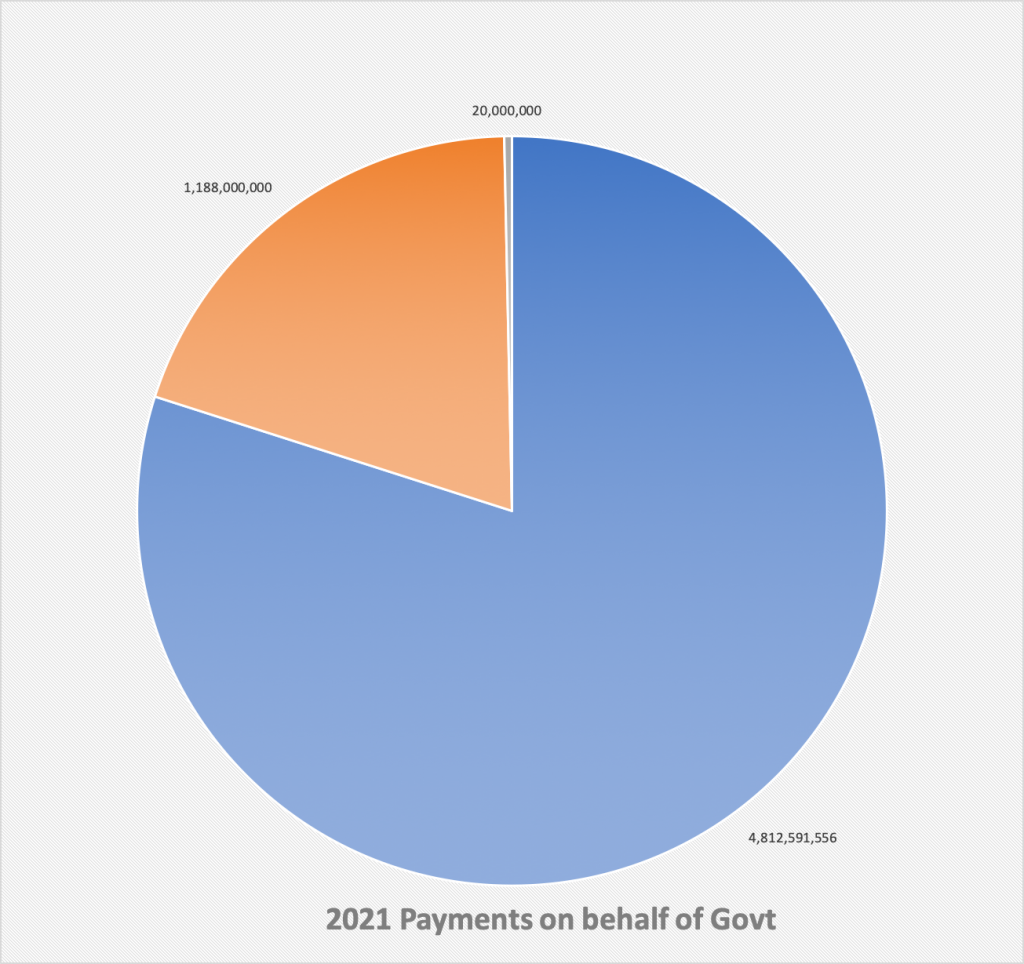

Finance always has an outsize share, because it handles things like debt repayment. Next year, about VT 4.8 billion will go to debt servicing and debt retirement. The government will continue its policy of paying down debt ahead of schedule. In 2019, about VT 3 billion was ‘pre-paid’.

Spending on education remains high. In 2021, the Ministry of Education will receive the second largest share of overall spending, about VT 9.7 billion overall. Most of that—VT 7.2 billion—will go to service salaries.

Health will receive an unusually large allocation next year. Over VT 1 billion of that will go to emergency preparedness. Given the open-ended state of the COVID crisis, this is likely necessary.

Internal Affairs is VT 3.35 billion, about 6% of all spending. Half of that will go it paying Police and VMF salaries. Their ranks have risen drastically in the last 3 years.

Despite the recent focus on agri-business, overall spending by the Ministry of Agriculture will remain consistent with past years. But new roads and road extensions in Pentecost, south Santo and Tanna will be certain to have a major impact on farmers, improving access to markets and reducing domestic costs.

Perhaps the most surprising element of next year’s budget is the lack of support for tourism and tourism-related indigenous business. The Vanuatu Tourism Office budget remains unchanged from the planned VT 350 million, and the tourism development budget is a relatively paltry VT 184 million. Cooperatives will receive slightly more, at VT 226 million, but Industry and Commercial development will get less, just over VT 150 million each.

Income Remains Solid

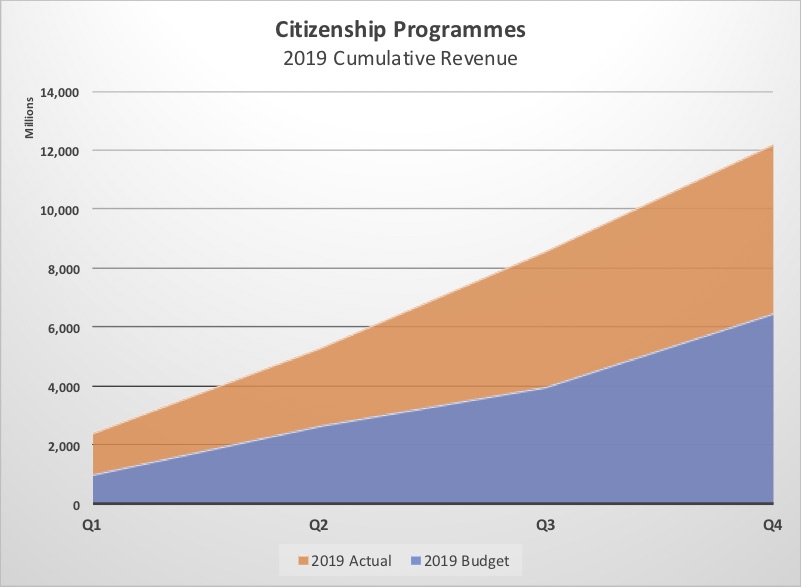

Despite the recent financial havoc, Finance has continued aggressively attacking our debt. Citizenship-related revenues could dry up at any time. But as long as they don’t, the country remains remarkably solvent.

Citizenship programme revenues blew past expectations in 2019, the last year for which we have complete revenue figures. The first quarter of 2020 showed every sign that the trend would continue. Almost VT 3.4 billion was earned from the programmes, against a budget of VT 1.3 billion.

Other revenues have been softer. Income generated from taxes, duties and related sources was underperforming as of Q2 this year. Overall, income came in at VT 7.9 billion, about VT 250 million short of expectations.

But when citizenship programmes are factored in, the picture inverts. Overall, the government was at about 60% of expected revenues by the middle of this year.

Outlook

Consistent performance seems to be lending an air of stability to the national economy, and that translates into spending plans, which look like more of the same. But there’s one glaring gap: No contingency has been put in place to allow for income or business subsidies.

The government’s GDP numbers aren’t comforting. Finance’s impact assessment report on COVID-19 and TC Harold suggested that our economy would slow to close to zero growth. But in Parliament two weeks ago, Finance Minister Johnny Koanapo told MPs that GDP for 2020 would be -4.2%. That’s a big difference.

Finance experts explained that the first estimate was based on COVID-19 lasting about six months. The number quoted by the Minister was for a contingency where the pandemic continued for the entire year.

Next year, according to his projection, our economy will recoup most of this year’s losses. But we don’t know when this projection assumes the borders will re-open. As long as the government is unwilling to return to business as usual, it’s going to be hard to predict anything with any confidence.